I have been deeply interested in the competitive response to Trump’s tariffs. For many reasons Trump’s actions are unprecedented and it is fascinating to observe how different countries, companies and political systems are responding in their own unique ways.

The inherent volatility in Trump’s actions is also slowly but surely getting reflected in bond yields. Recent FT article outlined an interesting way that firms are responding to this risk. Below is my summary and take-aways from the article.

Popularity of panda bonds

Panda bond refers to a CNY denominated bond issued by a non-Chinese/offshore entity in China’s onshore bond market that is available to both onshore and offshore investors.

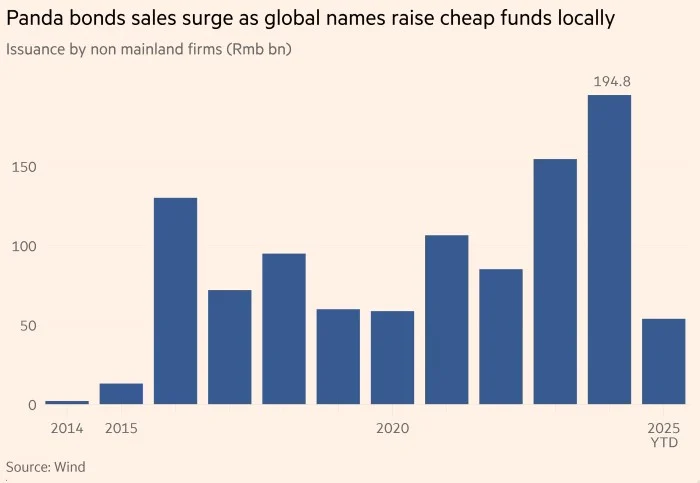

Recent data indicates that instead of raising capital abroad and transferring it to their Chinese subsidiaries, many companies are issuing debt locally in China. Firms not only reduce transaction costs but also prepare for potential disruptions in cross-border capital flows should the US-China trade conflict escalate. This is termed as “China for China” funding strategy.

Below are some key stats:

Why the surge?

Several major names, including Mercedes-Benz, HSBC, and Trafigura, have been at the forefront of this shift. The appeal? Primarily, China’s ultra-low interest rates. While the US and Europe have experienced rising borrowing costs, China’s 10-year sovereign bond yields are hovering near historic lows—prompting global firms to seek funding where it’s cheapest.

According to Wind data, the average coupon rate for panda bonds dropped below 2% in early 2025, down from 3.4% in 2022. With such low costs, more companies are expected to tap into this market throughout the year.

Other considerations

While cheaper finance is a strong reason but given the volatility introduced by Trump’s on-again off-again approach towards tariffs, there are several other key reasons why the panda bonds strategy makes sense for multinational corporations.

In summary

For global companies seeking financial flexibility and insulation from geopolitical risks, China’s bond market offers a compelling—and increasingly popular—opportunity

As the financial landscape continues to shift, panda bonds may become more than just an emerging market niche—they could represent a fundamental shift in how global companies manage risk and capital in a multipolar world.