Recently United States congress was urged to raise the debt ceiling by mid-July to keep the federal government from defaulting on its debt. This made me wonder who would be holding the bag in case of such a default. Or in other words – who owns this debt

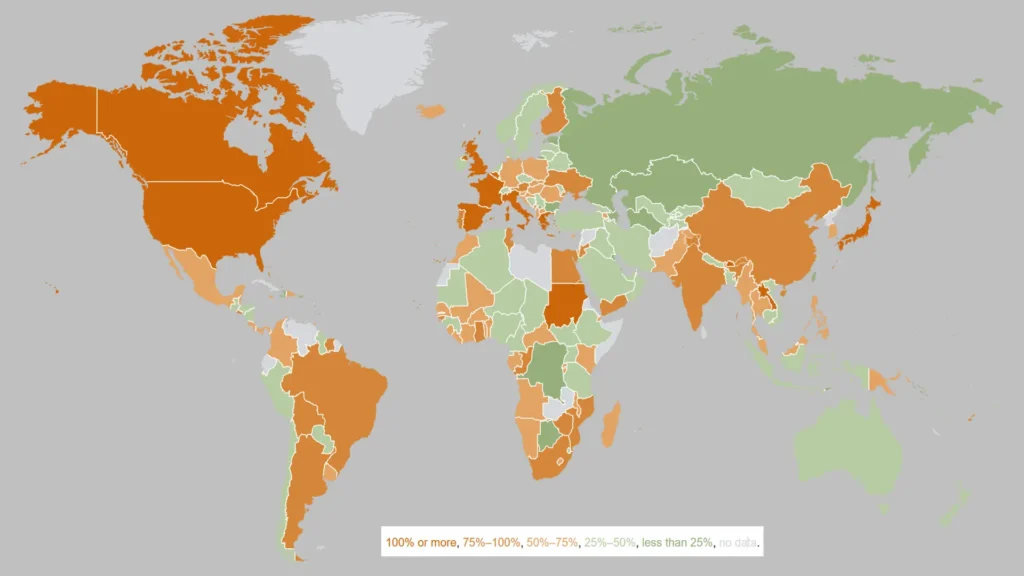

It doesn’t take long to discover that nearly all countries are debtors and this is visualised in the below picture where debt is shown as % of GDP:

This raises the question: If nearly every country in the world is in debt—and most are—you might wonder: Who do they all owe money to? It’s a fair question, and one that doesn’t get asked often enough.

The Scale of Global Debt

As of the latest available data (mostly from 2023 and 2024), the world’s total national debt is around $100 trillion. That number shifts constantly, of course, but it gives us a starting point.

The United States is the single largest debtor, with national debt now climbing towards $36 trillion—roughly one-third of all the government debt in the world. Following the U.S., the biggest borrowers include:

But it’s not just these major economies—almost every country in the world (with the exception of a few failed states) carries national debt

So Who Actually Owns This Debt?

You might imagine that governments owe money to each other. And while there is some truth to that, it’s far from the whole picture.

Here’s the surprising bit: More than 80% of the world’s national debt is owned privately.

Who are these private owners?

If you have a pension fund, chances are some of your retirement savings are invested in government bonds—meaning you’re a creditor to your own government. In the UK, for instance, nearly 30% of all government debt is held by pension and insurance companies. That’s because government bonds are seen as the safest assets for long-term commitments like pensions. In the U.S., Europe, and many other countries, the situation is very similar.

What About Foreign Governments?

Foreign countries do hold portions of each other’s debt—but not as much as you might think. For example

Final Thoughts

Here’s a core idea that’s often missed:

When governments spend more than they tax, they issue debt. That debt becomes money circulating through the economy. So the question isn’t just about how much debt exists—but who owns it and who benefits from it.

We will explore this question further in one of the upcoming posts.